815

815

VOID CHECK PROCESS OPTIONS

Is the check part of a previous Bank Reconciliation and currently showing as Outstanding?

® IF YES, proceed to HOW TO PROCESS A CHECK ADJUSTMENT

® IF NO, proceed to HOW TO PROCESS A VOID CHECK

PLEASE NOTE - You would never ADJ OR VOID a reconciled check.

HOW TO PROCESS A CHECK ADJUSTMENT

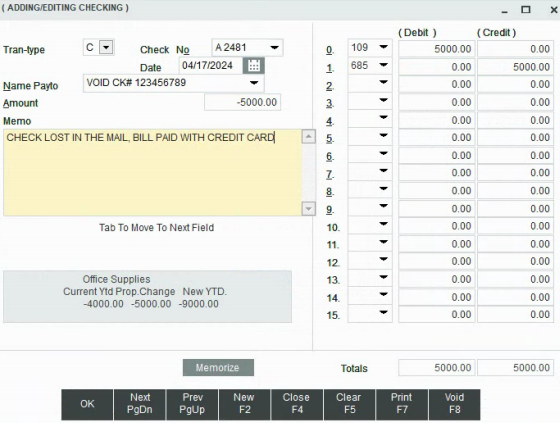

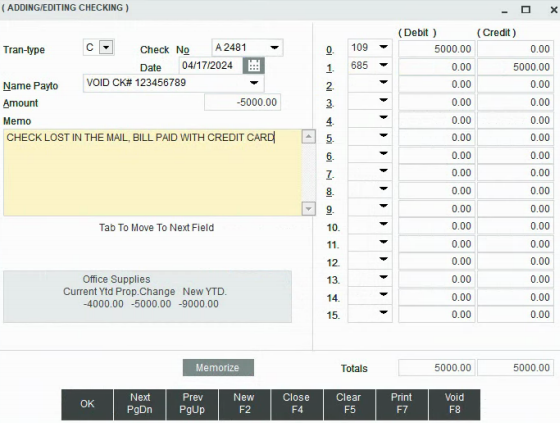

Go to the check register > NEW F2 and complete as follows:

|

Trans Type

|

[C]

|

|

Check No

|

[Change to an A #, do not use a paper check #]

|

|

Date

|

[Current month or month currently reconciling bank]

|

|

Name

|

[VOID CK# xxxxxxx (the original check #)]

|

|

Amount

|

[Negative value of the original check amt]

|

|

Memo

|

[Brief explanation of why the check is being adjusted out]

|

|

Debit

|

[Bank GL = Amt of original check]

|

|

Credit

|

[Depends on whether the payment will be reissued from AP]

® If the payment WILL NOT be reissued, credit the original purchase GL.

® If the payment WILL be reissued from AP, credit suspense GL. NEVER POST A CHECK ADJUSTMENT TO THE AP GL!!

|

On the next bank reconciliation, reconcile both the original check and the check adjustment you've just created.

The NET value of both records must be zero.

·

·

·

HOW TO PROCESS A VOID CHECK

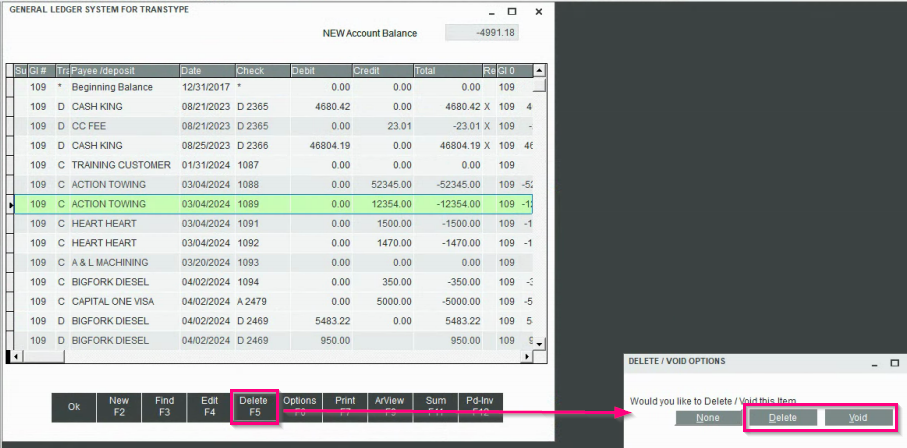

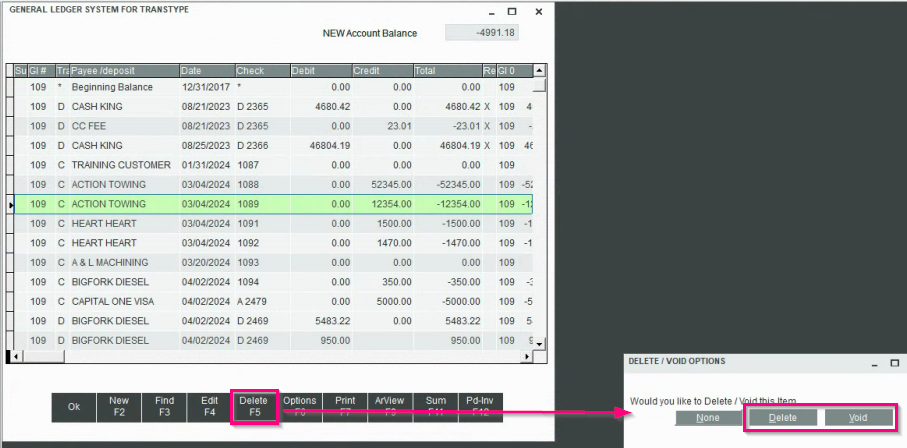

Go to the check register > highlight the check to be voided > from the bottom menu click Delete F5

From the DELETE/VOID OPTIONS window, please choose the appropriate action:

DELETE

® If the paper check was not destroyed and can still be used, click the Delete button.

This process will serve two purposes:

1) It will remove the check in the register making the check # available to use again.

2) It will move any paid accounts payable bills back to unpaid, if applicable.

VOID

® If the paper check was destroyed or lost, click the Void button.

This process will serve two purposes:

1) It will retain the check in the register as a VOID and clear its value.

2) It will move any paid accounts payable bills back to unpaid, if applicable.

UNDERSTANDING CHECKS

Checks that are written to pay AP bills are issued from the Accounts Payable sub-ledger.

In the check register, when viewing a check issued from AP, the GL for AP will be in the debit field.

AP bills are "attached" to that check. The distribution of the bills (inventory, expenses, etc…) is in AP on the paid bill.

To see the bill details go to the Paid Invoices in Accounts Payable and use [F4].

You cannot pay AP from the check register!!

Checks that are written for regular expenses or manual checks are issued from the Check Register.

Manual or Direct Checks written through the Check Register will not be distributed to the Account Payable General Ledger and will not have Paid Invoices attached to them.